is online shopping safe with debit cards is a question many of us face as digital shopping becomes more a part of our everyday lives. Whether it’s grabbing groceries from your favorite app or scoring a deal on your go-to online store, using a debit card online is quick, convenient, and familiar. But with that ease comes a healthy dose of curiosity about just how protected your money is when you hit “buy.”

In this overview, you’ll discover how online debit card transactions work, the potential security threats they face, and the growing set of bank features meant to keep your funds safe. We’ll dive into practical tips for shopping smart, compare debit cards to credit cards for online purchases, spotlight the role of payment gateways and merchants, and Artikel what to do if your debit card details ever fall into the wrong hands. By the end, you’ll have a clearer sense of how safe it is to use your debit card online and the most effective ways to protect yourself.

Overview of Online Shopping with Debit Cards

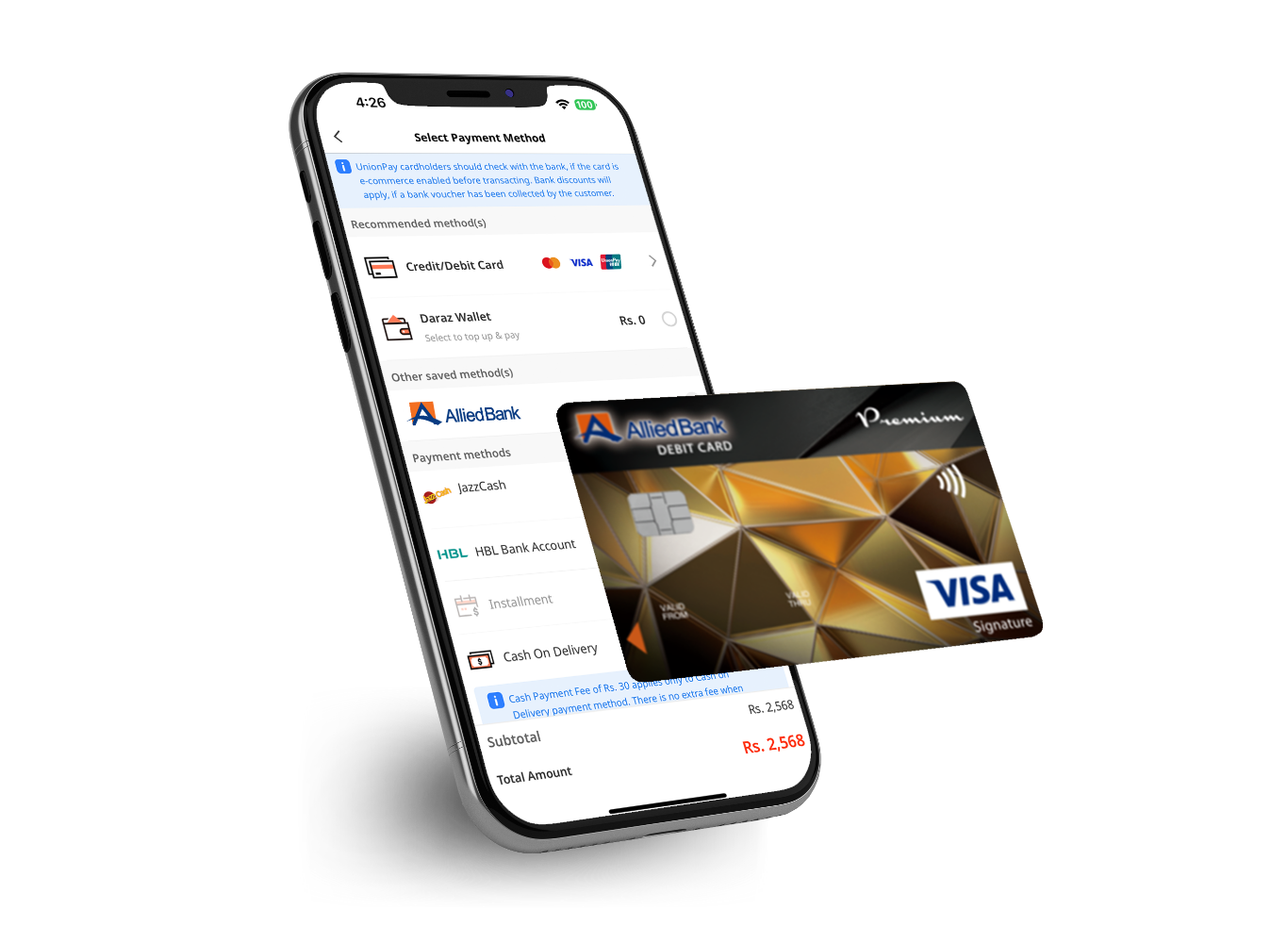

Shopping online with debit cards has become a common practice for millions of people worldwide. With the rise of e-commerce, using debit cards for online purchases is now as routine as paying in-store. Shoppers simply enter their card details at checkout on websites or apps, and the payment is debited directly from their bank account in real-time.

Debit cards are widely used due to their convenience, allowing users to control spending within the available balance. They are especially popular for everyday purchases, paying for subscriptions, and booking travel or services online. In regions where credit card penetration is lower, debit cards often serve as the primary tool for digital transactions.

During an online transaction with a debit card, your card data is transmitted securely to the payment processor, which then communicates with your bank to authorize and complete the payment instantly. Funds are deducted from your account almost immediately, and both you and the merchant receive confirmation of the transaction.

Potential Risks of Using Debit Cards Online

Despite their convenience, using debit cards online exposes users to certain security threats. These risks can put your hard-earned money and sensitive information in danger if not managed properly. Understanding these potential threats is essential for any online shopper using a debit card.

- Fraud: Cybercriminals may use stolen debit card information to make unauthorized purchases, draining funds directly from your bank account.

- Phishing: You might receive fake emails or messages tricking you into providing your card details to fraudulent websites disguised as legitimate retailers or banks.

- Data Breaches: Hackers may target retailers or payment processors, compromising databases containing debit card numbers and personal information.

When debit card information is compromised, the consequences can be immediate and severe. Unlike credit cards, which may offer a buffer period before actual funds are affected, a compromised debit card can lead to instant loss of money from your checking account, potential overdraft fees, and lengthy recovery processes with your bank.

Security Features Offered by Banks for Online Debit Card Use

To address these risks, banks implement a variety of security features specifically designed to protect online debit card transactions. These measures help reduce fraud and increase user confidence in digital purchases. Here are some of the most common security features provided by banks:

| Feature | Description | Effectiveness | User Actions |

|---|---|---|---|

| Real-Time Transaction Alerts | SMS or app notifications for every online transaction | High for early fraud detection | Enable alerts and review immediately |

| OTP (One-Time Password) | Unique code sent for transaction authorization | Very high for preventing unauthorized use | Keep phone secure; don’t share OTP |

| 3D Secure Protocols (e.g. Verified by Visa, Mastercard SecureCode) | Additional authentication step at checkout | High against online card fraud | Register and use 3D Secure when prompted |

| Card Blocking & Limits | Temporary block or set limits for online transactions | Moderate, minimizes damage if details are lost | Adjust settings via banking app or customer service |

Real-time alerts, OTPs, and 3D Secure protocols work by adding extra layers of authentication and transparency to every transaction, making it harder for unauthorized parties to misuse your card details. Strong customer authentication, now required in many regions, further protects transactions by ensuring only the legitimate cardholder can approve online purchases, using a combination of something they know (password/PIN), have (their phone), or are (biometric).

Best Practices for Safe Debit Card Shopping Online

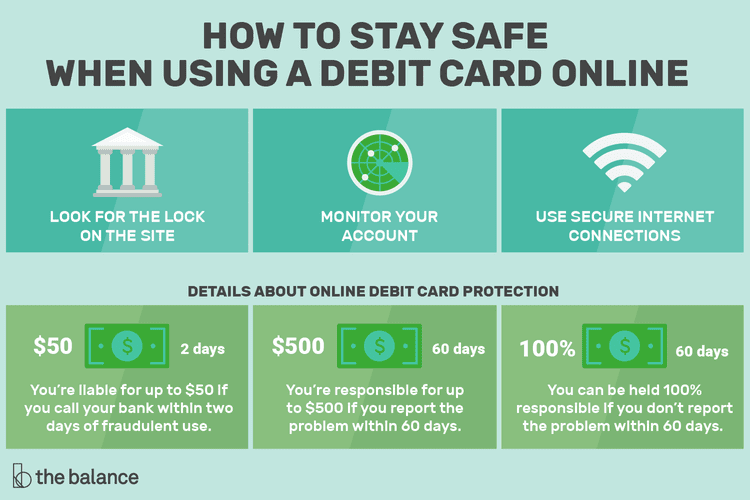

Staying safe while shopping online with your debit card isn’t just about relying on bank security features—it also requires responsible user behavior. By following proven safety tips, you can minimize risks and enjoy peace of mind with every purchase.

- Always shop on reputable websites and look for secure HTTPS connections.

- Use trusted payment gateways rather than entering card details directly on unfamiliar sites.

- Enable transaction alerts and regularly monitor your bank account activity.

- Create strong, unique passwords for all your shopping accounts and avoid using the same password across multiple sites.

- Keep your devices updated with the latest security patches and antivirus software.

- Never share your card details, OTPs, or PIN with anyone—even if they claim to be from your bank.

- Log out after completing purchases, especially when using shared or public computers.

- Use two-factor authentication wherever available for extra protection.

Recognizing secure websites often involves checking for a padlock icon and “https://” in the browser’s address bar. Trusted payment gateways such as PayPal, Stripe, or Apple Pay provide additional layers of security, protecting your card data from potential breaches. Strong passwords, frequent software updates, and awareness of phishing tactics all contribute significantly to a safer online shopping experience.

Comparing Debit Cards to Credit Cards for Online Purchases

When making purchases online, choosing between a debit card and a credit card can have a big impact on your safety and protection. Both methods have their strengths and weaknesses, especially when it comes to managing risks and resolving disputes.

| Card Type | Risk Level | Dispute Process | Protection Features |

|---|---|---|---|

| Debit Card | Higher—direct account access | Slower, funds are already withdrawn | Basic fraud monitoring, limited liability |

| Credit Card | Lower—uses credit line, not direct funds | Faster, more robust chargeback rights | Comprehensive fraud protection, zero liability in many cases |

Credit cards typically provide stronger consumer protections than debit cards. For example, if your credit card is compromised, you’re usually not liable for unauthorized charges, and the dispute process is generally faster and more streamlined. With debit cards, your actual money is at risk, and it may take days or even weeks to recover lost funds following a fraudulent transaction.

For high-value purchases, travel bookings, or when shopping on unfamiliar websites, using a credit card may offer greater peace of mind due to enhanced dispute and liability protections.

Role of Payment Gateways and Merchant Security

Payment gateways play a critical role in securing online debit card transactions. They act as intermediaries between shoppers, merchants, and banks, ensuring that sensitive card information is encrypted and transmitted safely. The effectiveness of a payment gateway directly affects transaction safety and overall consumer trust.

- PayPal

- Stripe

- Adyen

- Authorize.net

- Square

These reputable payment gateways invest heavily in advanced security measures, including robust encryption, tokenization, and fraud detection algorithms. Merchant compliance with Payment Card Industry Data Security Standard (PCI DSS) is also crucial, as these standards Artikel strict requirements for handling, processing, and storing cardholder data, helping minimize the risk of data breaches and fraud.

Steps to Take if Debit Card Information is Compromised: Is Online Shopping Safe With Debit Cards

If you suspect your debit card details have been compromised, acting quickly is vital to reduce financial losses and restore security. The following steps Artikel a typical response procedure after discovering debit card fraud:

- Immediately contact your bank to report the unauthorized transaction and request an instant card block or freeze.

- Review recent transactions and identify any other suspicious activity.

- File a fraud report with your bank according to their procedures and request a replacement card.

- Update your login credentials for online banking and shopping accounts.

- Monitor your account closely for ongoing unauthorized activity over the coming weeks.

- If necessary, file a police report or fraud complaint with local authorities for further investigation.

Reporting unauthorized transactions promptly is essential, as most banks have specific time limits for filing disputes. Monitoring your account regularly helps detect additional fraud, while cooperation with your bank increases the likelihood of recovering lost funds or reversing fraudulent charges.

Technological Innovations Enhancing Debit Card Safety Online

Recent advancements in financial technology have significantly enhanced the security of online debit card transactions. Encryption and tokenization now play a major role, converting sensitive card details into secure, non-reusable tokens that are useless to hackers if intercepted.

Biometric authentication, such as fingerprint or facial recognition, is increasingly integrated into online banking and payments, making it harder for unauthorized users to approve transactions. With the rise of these innovations, the future of debit card safety looks promising.

With ongoing innovation in encryption, biometric verification, and real-time fraud detection, the future of online debit card shopping will be more secure, user-friendly, and resilient against emerging cyber threats.

Closure

Shopping online with a debit card doesn’t have to be risky if you stay informed and proactive. By understanding the potential dangers, embracing the security measures banks and payment platforms offer, and following best practices, you can shop with much greater confidence. Take control of your digital spending experience and remember that a few smart choices today can help keep your finances secure tomorrow.

Commonly Asked Questions

Are debit cards safer than credit cards for online shopping?

Credit cards often offer better fraud protection and less liability for unauthorized transactions than debit cards, making them a safer option for many online purchases.

What should I do if my debit card is used fraudulently online?

Contact your bank immediately, report unauthorized transactions, block the card, and monitor your account for further suspicious activity.

How do I know if a website is secure for using my debit card?

Look for “https://” in the URL, a padlock icon in the browser, and stick to trusted and reputable sites or payment gateways.

Can I get my money back if someone steals my debit card information online?

Refunds may be available, but the process can take time, and you may be responsible for some losses if not reported quickly. Policies vary by bank and region.

Is it safe to save my debit card details on shopping sites?

It’s generally safer not to save your card details on websites; if you do, use strong, unique passwords and enable two-factor authentication wherever possible.