With Humana Supplemental Medicare Insurance at the forefront, this guide delves into the various aspects of this insurance, offering insights on coverage options, enrollment process, costs, network coverage, and customer satisfaction.

Introduction to Humana Supplemental Medicare Insurance

Humana Supplemental Medicare Insurance is an additional insurance plan designed to provide coverage beyond what original Medicare offers. The purpose of this supplemental insurance is to help fill in the gaps left by traditional Medicare, offering individuals peace of mind and financial protection in case of unexpected medical expenses. By choosing Humana Supplemental Medicare Insurance, individuals can access a range of benefits and coverage options that may not be available with other providers.

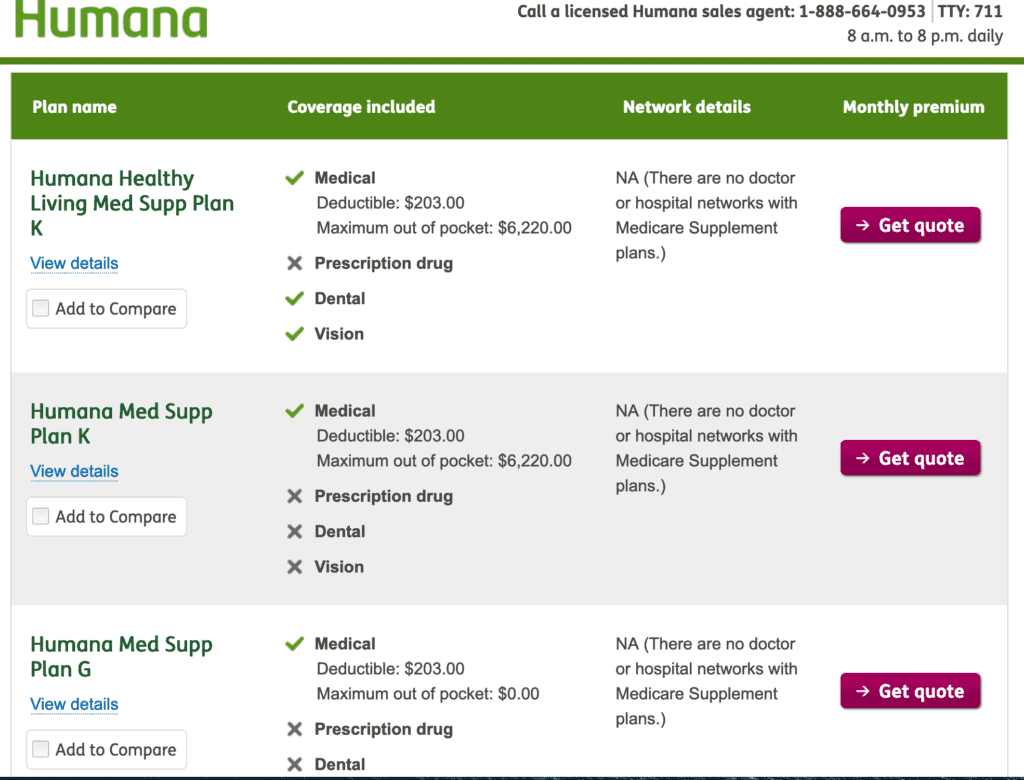

Coverage Options

- Medicare Part A and Part B Coinsurance

- Prescription Drug Coverage

- Vision and Dental Coverage

- Health and Wellness Programs

Enrollment Process

- Visit the Humana website or call their customer service to learn about available plans.

- Compare the coverage options and select the plan that best suits your needs.

- Complete the enrollment form and submit any required documentation.

- Wait for confirmation of your enrollment and start enjoying the benefits of Humana Supplemental Medicare Insurance.

Cost and Pricing

| Plan Type | Average Monthly Cost |

|---|---|

| Medicare Part A and Part B Coinsurance | $100-$200 |

| Prescription Drug Coverage | $50-$100 |

| Vision and Dental Coverage | $30-$50 |

| Health and Wellness Programs | $20-$40 |

Network Coverage

- Humana has a wide network of healthcare providers and facilities across the country.

- Individuals can easily find in-network providers by using the provider search tool on the Humana website.

- Choosing in-network providers can lead to lower out-of-pocket costs and better coordinated care.

Customer Experience and Satisfaction, Humana supplemental medicare insurance

Customer reviews of Humana Supplemental Medicare Insurance have been overwhelmingly positive, highlighting the ease of enrollment, comprehensive coverage, and excellent customer service.

- Customers have praised the responsiveness of Humana’s customer service team and their willingness to assist with any queries or concerns.

- The unique benefits and features offered by Humana, such as health and wellness programs, have contributed to high levels of customer satisfaction.

Final Conclusion

In conclusion, Humana Supplemental Medicare Insurance provides a robust solution for individuals seeking additional coverage beyond basic Medicare. With its diverse options and focus on customer satisfaction, it stands out as a reliable choice in the realm of supplemental insurance.

FAQ Compilation: Humana Supplemental Medicare Insurance

Is Humana Supplemental Medicare Insurance only for seniors?

No, Humana Supplemental Medicare Insurance is available for individuals of all ages who are eligible for Medicare.

Can I switch my coverage options within Humana Supplemental Medicare Insurance?

Yes, you can switch your coverage options during certain enrollment periods or qualifying events.

Are prescription drugs covered under Humana Supplemental Medicare Insurance?

Yes, prescription drug coverage is typically included in many of the plans offered by Humana Supplemental Medicare Insurance.

How do I find in-network healthcare providers?

You can easily find in-network providers by using the provider search tool on the Humana website or contacting customer service.