Workers compensation insurance california requirements encompass vital aspects that businesses in the state must adhere to. Understanding these guidelines is crucial for compliance and protection.

Exploring the specifics of coverage, unique industry requirements, and the process of obtaining insurance in California sheds light on the importance of this topic.

Workers Compensation Insurance in California

Workers compensation insurance is a crucial safety net for employees in California. This type of insurance provides coverage for medical expenses and lost wages in the event of a work-related injury or illness. It is mandatory for businesses in California to provide workers compensation insurance to protect their employees and comply with state regulations.

Key Requirements for Businesses in California

Businesses in California are required to carry workers compensation insurance if they have one or more employees, including part-time and full-time workers. Failure to provide workers compensation insurance can result in severe penalties, including fines and legal action. It is essential for businesses to ensure compliance with these requirements to avoid costly consequences.

Penalties for Non-Compliance

Businesses that fail to provide workers compensation insurance in California may face penalties such as fines, lawsuits, and even criminal charges. Non-compliance with workers compensation insurance requirements can lead to financial losses and reputational damage for businesses. It is in the best interest of employers to prioritize the safety and well-being of their employees by adhering to these regulations.

California Workers Compensation Insurance Requirements: Workers Compensation Insurance California Requirements

In California, businesses are required to provide workers compensation insurance that covers medical treatment, disability benefits, and death benefits for employees who are injured or become ill due to work-related incidents. The specific coverage requirements vary based on the type of industry and the size of the business.

Coverage Requirements for Small Businesses vs. Large Corporations

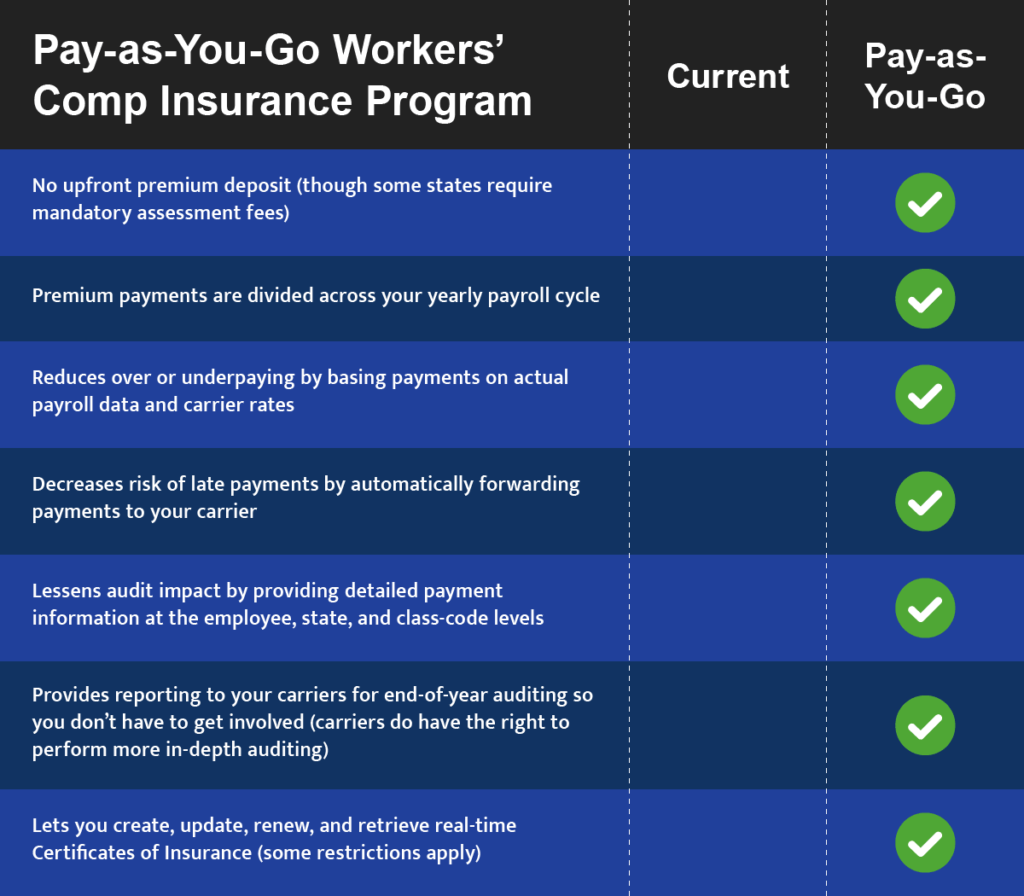

Small businesses in California are subject to the same workers compensation insurance requirements as large corporations. However, the premiums and coverage limits may vary based on the size and nature of the business. Large corporations may opt for self-insurance programs, while small businesses typically purchase coverage from insurance carriers.

Industries with Unique Requirements, Workers compensation insurance california requirements

Certain industries in California, such as construction, healthcare, and agriculture, have unique workers compensation insurance requirements due to the high risk of work-related injuries. These industries may need additional coverage options or specialized policies to protect their employees adequately.

Obtaining Workers Compensation Insurance in California

Businesses in California can obtain workers compensation insurance through licensed insurance carriers or brokers who specialize in workplace insurance. Insurance brokers play a vital role in helping businesses navigate the complex requirements of workers compensation insurance and find the best coverage options for their specific needs.

Shopping for the Best Policy

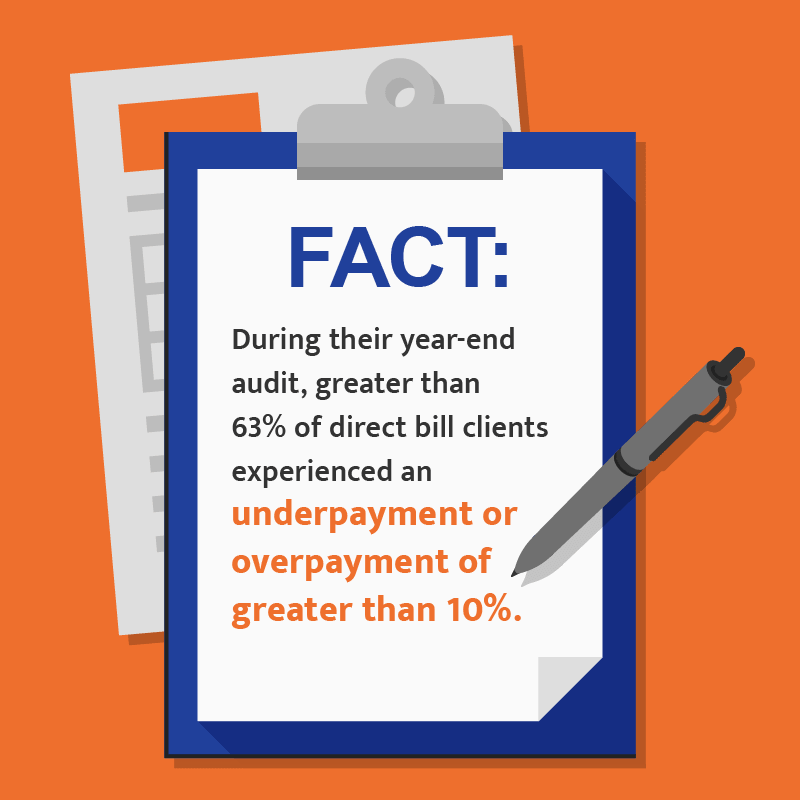

When shopping for workers compensation insurance in California, businesses should compare quotes from multiple insurance providers, consider the coverage limits and deductibles, and review the policy terms and conditions carefully. It is essential to work with an experienced insurance broker to ensure that the policy meets all state requirements and provides comprehensive coverage.

Managing Workers Compensation Claims in California

Filing a workers compensation claim in California involves notifying the employer, seeking medical treatment, and submitting a claim form to the insurance carrier. Employers and employees have specific responsibilities when it comes to managing workers compensation claims, including reporting incidents promptly and cooperating with the claims process.

Legal Aspects of Handling Claims

Employers must comply with state laws and regulations when handling workers compensation claims in California to avoid legal disputes and penalties. It is essential to follow proper procedures, document all relevant information, and communicate effectively with employees throughout the claims process to ensure compliance with the law.

Ultimate Conclusion

In conclusion, staying informed about workers compensation insurance california requirements is paramount for businesses to operate smoothly and responsibly. By following these guidelines, businesses can ensure the well-being of their employees and the legal integrity of their operations.

FAQ Resource

What are the consequences of not having workers compensation insurance in California?

Failure to provide workers compensation insurance in California can result in hefty fines, legal penalties, and even the suspension of business operations.

Are there any exemptions for certain types of businesses in California regarding workers compensation insurance?

While some small businesses with a limited number of employees may be exempt, it’s essential to check with the state authorities to determine eligibility for such exemptions.

Can businesses shop around for different workers compensation insurance policies in California?

Yes, businesses have the freedom to explore various insurance providers and policies to find the best coverage that suits their specific needs and budget.